McDowell County Register of Deeds

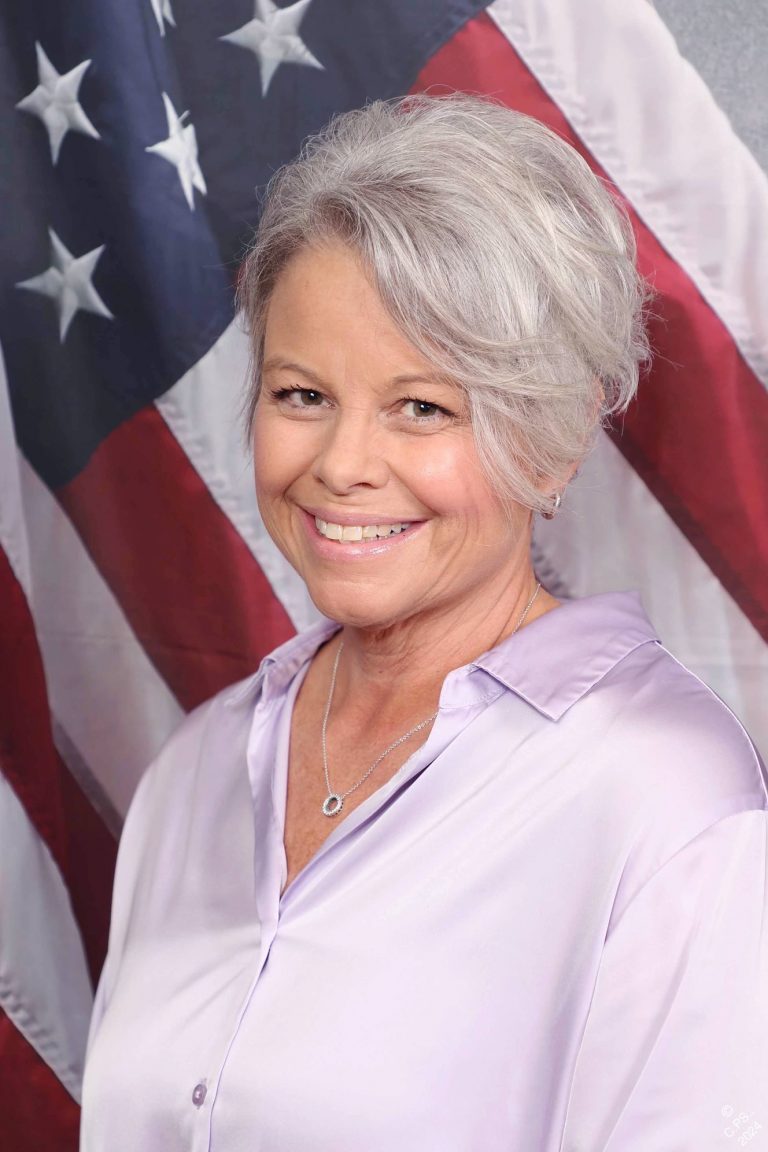

Lydia Tilley Effler, Registrar

Welcome to the McDowell County Register of Deeds! It is the mission of the McDowell County Register of Deeds to maintain the integrity, completeness, accuracy, and safekeeping of all public records. The Register of Deeds provides access to real estate and vital records in accordance with North Carolina General Statutes.

Here you will find links to assist you with all your searching and recording needs. We offer a wide-range of services including Searching Records, Electronic Recording Services, Assumed Names, Tax Certifcation and Recording Information.

In addition, you will find the Online Vital Records Request, Notary Information, Marriage License Information, and Military Discharge Record Filing Information.

It is my vision to provide you with “peace of mind” that your records are accessible and ready when you need them most.

Thank you,

Lydia Tilley Effler

Contact Information

Lydia Tilley Effler, Registrar

Phone: 828-652-4727

Email: Lydia.Effler@McDowellGov.com

Address:

35 West Fort St.

Marion, NC 28752

Office Hours

Monday - Friday 8:30 a.m. to 5:00 p.m.

Documents are recorded 8:30 a.m. to 5:00 p.m.

Marriage Licenses issued 8:30 a.m. to 4:30 p.m.

Additional Information

Please call the Register of Deeds office for additional information 828-652-4727

Our services

Search Records

Search Records online.

Recording Alert System

Get Alerts when documents are filed in your name.

Online Tax Services

Pay your taxes online by clicking here.

Online Vital Record Request

Request vital record copies online.

Online Marriage Form

Marriage License

All of North Carolina’s 100 County Register of Deeds issue marriage licenses that can be used anywhere in the state.

The license can be used immediately upon issuance and is good for 60 days. The original license must he returned to the county where it was issued. You may apply in McDowell County between the hours of 8:30 a.m. and 4:30 p.m. Mon-Fri. excluding holidays.